Financial Statement Governance

for Infor CloudSuite Clients

Bring structure and clarity to your financial statements — while your team stays in control.

WHY FINANCIAL STATEMENT GOVERNANCE MATTERS

Financial Statement Reporting Naturally Becomes Complex

Financial statements rarely become disorganized overnight.

Over time:

- New financial statements are created

- Customizations are layered onto existing reports

- Different versions begin circulating

- Rollups evolve

- Documentation becomes inconsistent

What begins as practical customization can gradually become structural complexity.

ECS helps finance teams establish governance around how financial statements are created, customized, and maintained — so reporting remains organized as it evolves.

WHAT ECS DOES

Financial Statement Governance

ECS focuses on the structure and organization of financial statements within Infor CloudSuite.

We work with finance teams to:

- Document how financial statements are built

- Clarify standards before new statements are created

- Identify overlapping or inconsistent versions

- Establish structured build guidelines

- Maintain documentation clarity over time

We do not modify ERP configuration, change accounting policy, or participate in month-end close.

Our role is governance — providing structured oversight and standards so financial statements remain consistent and sustainable.

BUILT TO STRENGTHEN INTERNAL CAPABILITY

ECS is designed for teams that want to build and maintain financial statements internally. We provide governance standards and structured guidance so your team can execute confidently — without outsourcing ownership.

FINANCIAL STATEMENT GOVERNANCE BLUEPRINT & ROADMAP

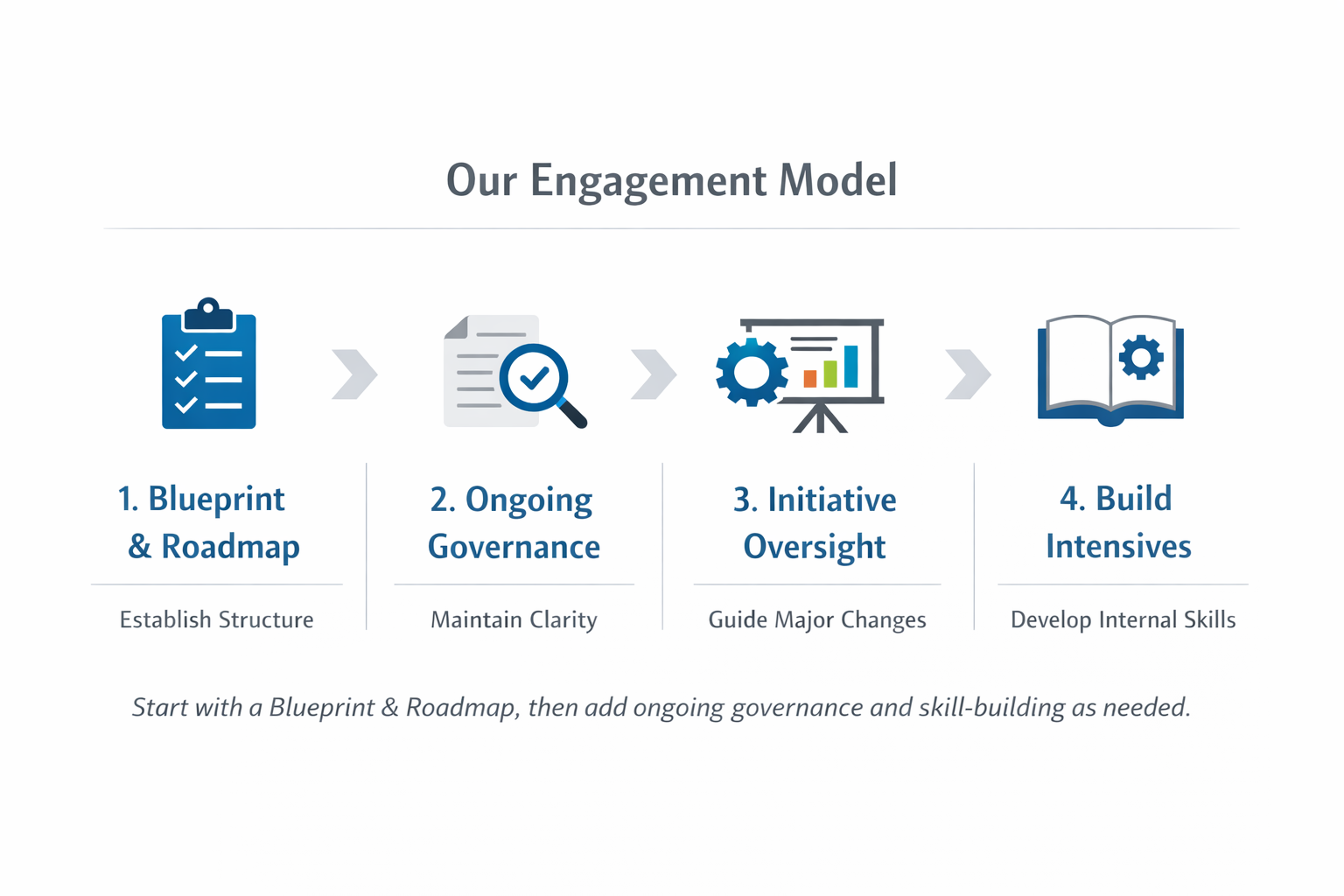

The Blueprint & Roadmap is the starting point.

Whether refining existing financial statements or creating new ones, this engagement establishes:

- Clear build standards

- Organized hierarchy and rollup application

- Documentation structure

- Defined governance guidelines

- A practical 90-day roadmap

The outcome is structured clarity before further customization occurs.

ONGOING GOVERNANCE SUPPORT

After the Blueprint, organizations may continue with structured governance support.

Governance includes monthly oversight sessions where:

- Financial statement changes are reviewed

- Proposed updates are discussed before implementation

- Documentation alignment is maintained

- Roadmap priorities are revisited

A written summary follows each session to document next steps.

ECS provides governance oversight. Your team executes.

FINANCIAL REPORTING INITIATIVE OVERSIGHT

When larger financial statement initiatives arise — such as new statement creation, redesign of consolidated reports, or structured cleanup — ECS provides defined oversight to maintain governance standards throughout the effort.

Initiatives are scoped separately and include structured checkpoints and post-implementation review.

FINANCIAL STATEMENT BUILD INTENSIVES

Strengthen Internal Development Capability

ECS offers focused Financial Statement Build Intensives designed specifically to strengthen internal development skills.

These sessions are hands-on and development-oriented.

They support your team in:

- Building new financial statements using structured standards

- Refining existing statements

- Applying consistent calculation and rollup design

- Organizing report logic for long-term sustainability

Unlike governance support, Build Intensives are skill-development engagements. They are designed to help your team build and refine financial statements independently and confidently.

Intensives may be scheduled independently or alongside governance engagements.

CERTIFIED INFOR PARTNER

ECS is a Certified Infor Partner. We specialize in Financial Statement Governance within Infor CloudSuite environments, bringing deep experience supporting structured reporting practices.

Ready to Establish Clear Financial Statement Governance?

Schedule a Reporting Discussion to determine whether the Financial Statement Governance Blueprint & Roadmap is the right starting point for your organization.